WafricNews | June 4, 2025

Lagos, Nigeria — Nigeria’s anti-corruption watchdog, the Economic and Financial Crimes Commission (EFCC), has declared two additional individuals wanted in connection with a massive digital investment fraud linked to the now-defunct trading platform, Crypto Bridge Exchange (CBEX).

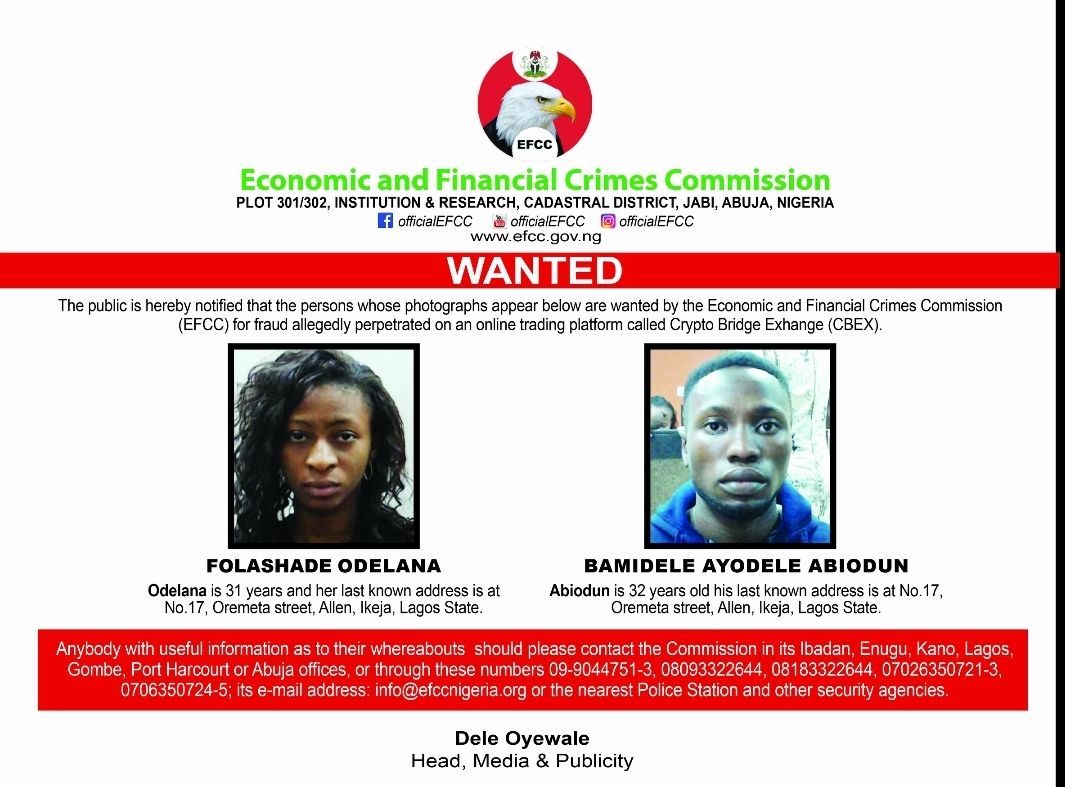

The newly named suspects—Folashade Odelana, 31, and Bamidele Ayodele Abiodun, 32—are accused of playing central roles in orchestrating a scheme that defrauded hundreds of thousands of Nigerians. The EFCC confirmed their wanted status on Wednesday through an official public notice posted across its digital platforms.

“The public is hereby notified that the persons whose photographs appear below are wanted by the EFCC for fraud allegedly perpetrated on an online trading platform called Crypto Bridge Exchange (CBEX),” the agency stated.

Both suspects reportedly operated from the same address: No. 17, Oremeta Street, Allen, Ikeja, Lagos—a location now at the center of one of Nigeria’s largest digital financial crimes in recent history.

The EFCC has so far declared 14 individuals wanted in total in connection with the CBEX scandal, which imploded in April 2025, leaving over 600,000 Nigerians in financial ruin and an estimated ₦1.3 trillion in investor losses.

The Commission has urged the public to come forward with any credible information on the suspects’ whereabouts. Reports can be made to any EFCC zonal office—Ibadan, Enugu, Kano, Lagos, Gombe, Port Harcourt, or Abuja—or via official hotlines and email.

Digital Promises, Real-World Consequences

CBEX had positioned itself as a lucrative cryptocurrency and forex trading platform, luring investors with promises of high returns and cutting-edge financial innovation. But what began as a beacon of digital opportunity has now revealed itself as a web of deception—further stoking calls for tighter oversight in Nigeria’s unregulated online investment space.

The EFCC’s widened search signals a deeper unraveling of the network behind CBEX and raises serious questions about investor protection, cyber-financial regulation, and public trust in digital finance platforms.

As investigations continue, the Commission maintains that justice will be pursued vigorously—and that those responsible for this nationwide financial shockwave will be held accountable.

By WafricNews Desk.

By WafricNews Desk.

Comment

To post a comment, you have to login first

LoginNo Comments Yet...